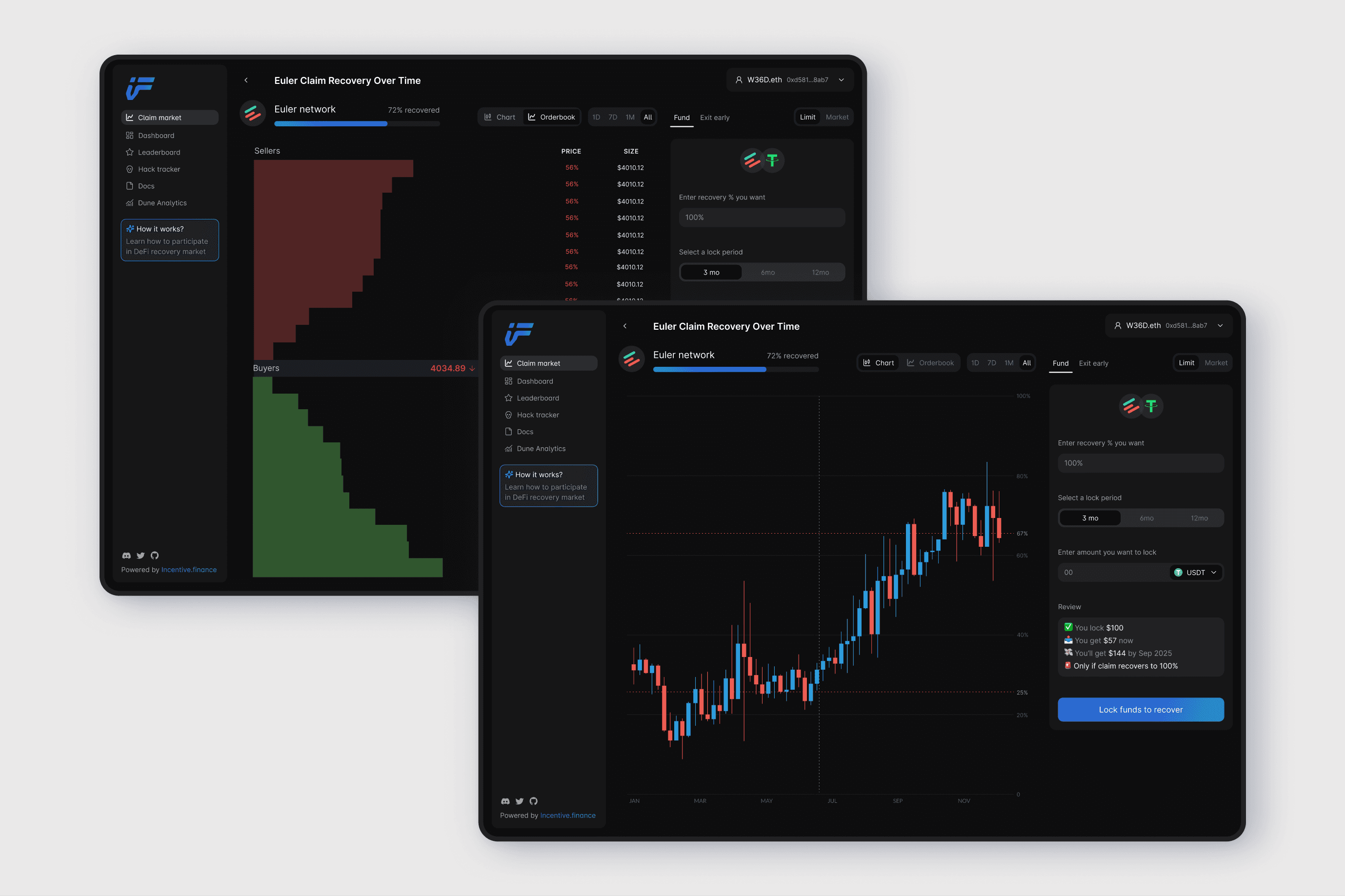

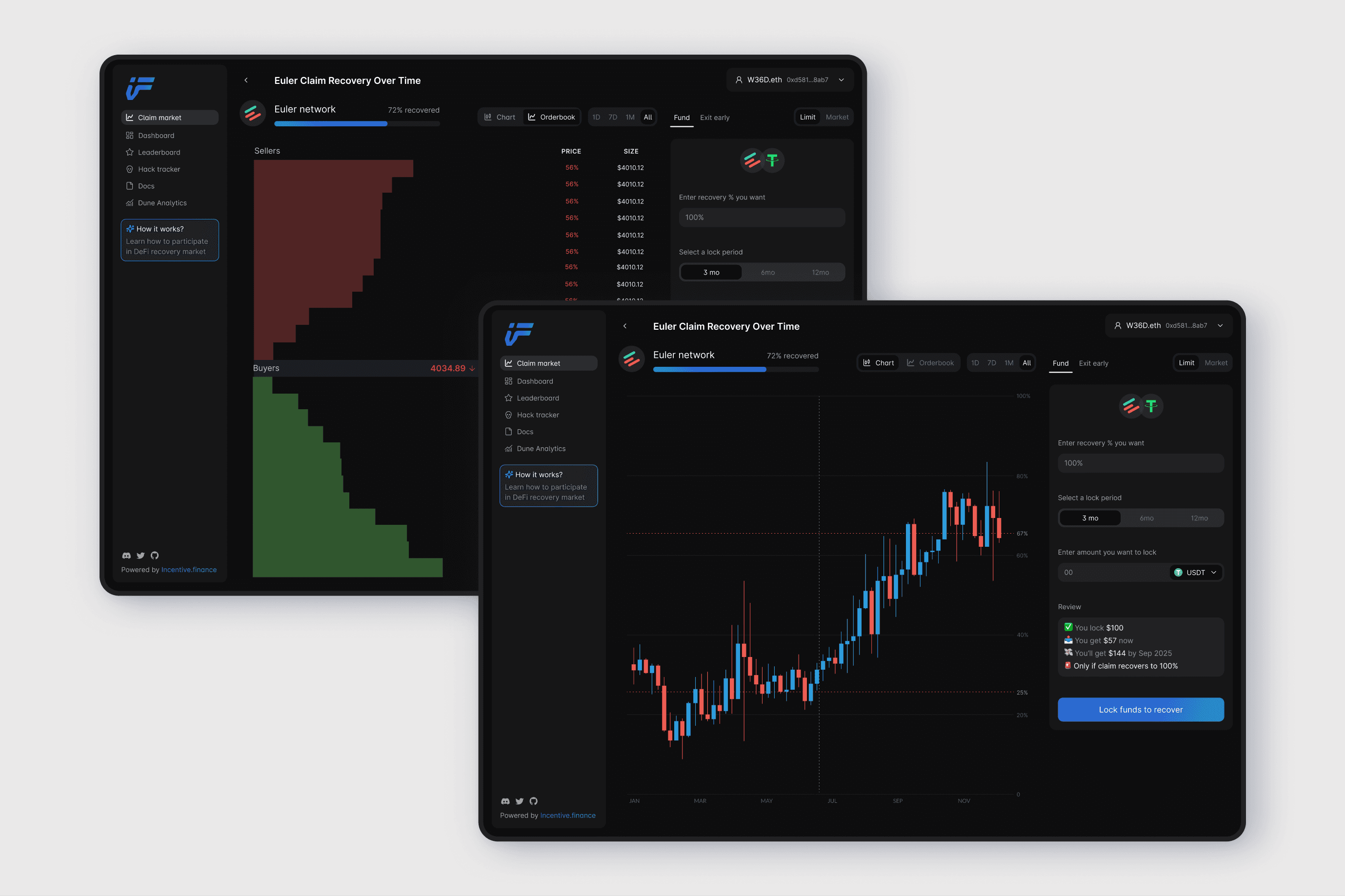

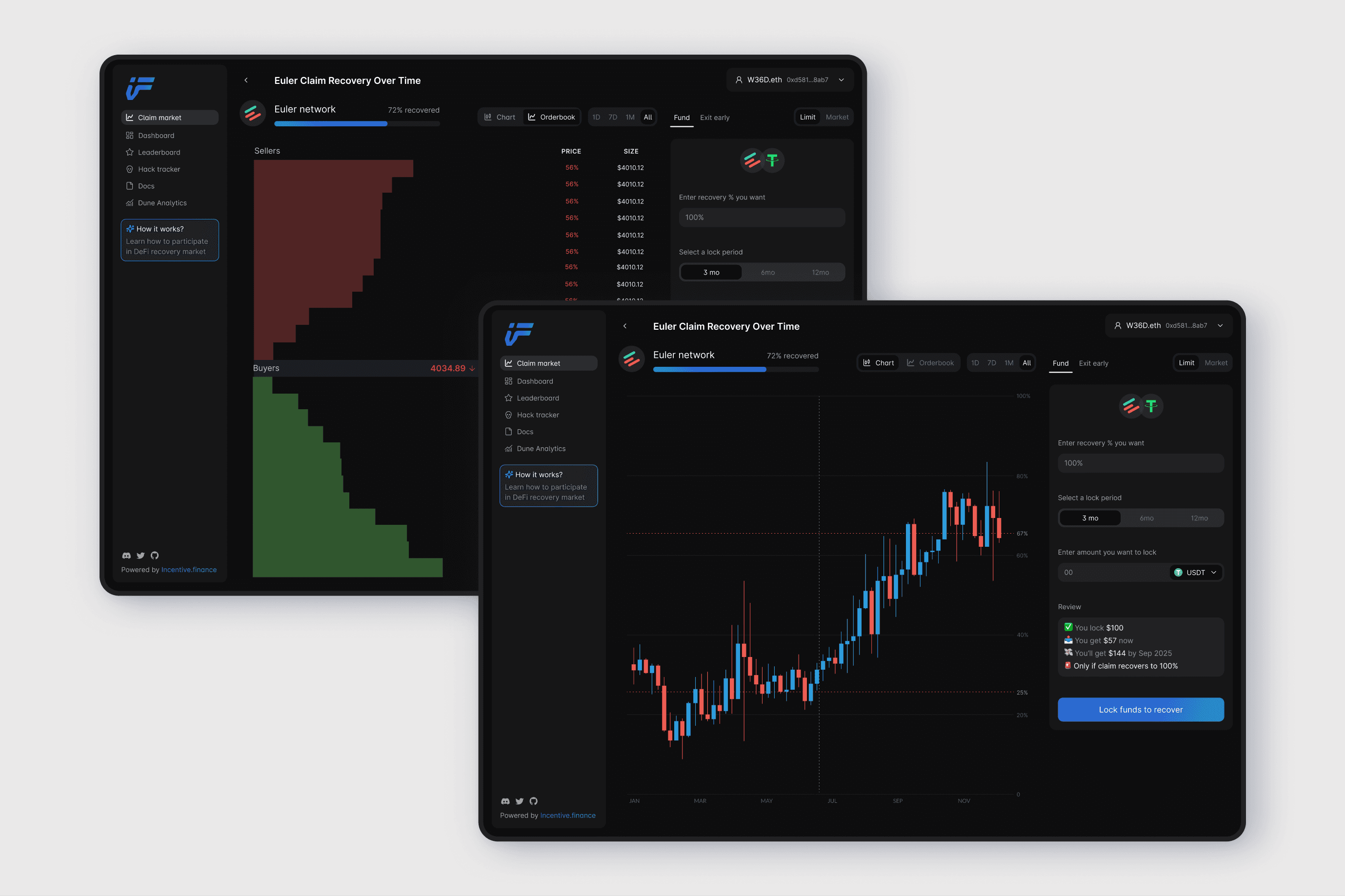

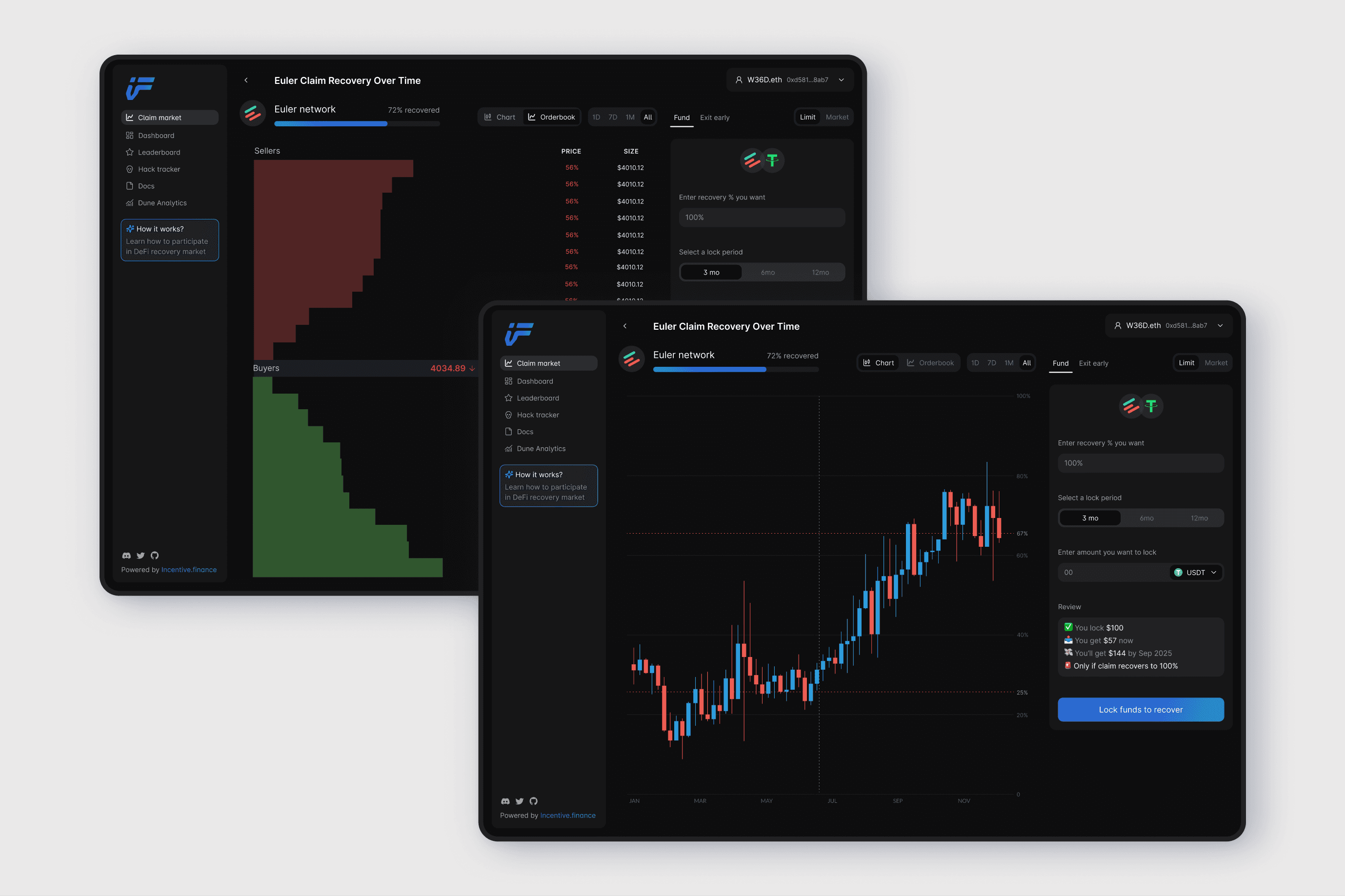

Designing the first ever DeFi claim exchange

2025

I was the only designer in a 5 member founding team. I took charge of design, UX writing, brand identity, and communication for launches at events. I was deeply involved in shaping product decisions and building the design language. I worked hand-in-hand with the founder and engineers to translate abstract mechanics, like collateralized claims and recovery probabilities, into a product people could use.

It's the first ever decentralized market where victims of DeFi exploits can instantly recover part of their funds and investors can trade on the potential recovery. It’s the first attempt to bring liquidity, structure, and trust to one of the most fragile corners of DeFi. Its unlocking an $10Bn+ untapped niche.

Outcome

17,500

unique users within

3 months of launch

3.3 M

Traded claims

Our testnet launch validated the design philosophy: clarity breeds trust. Users intuitively understood how to trade claims, a concept never seen before in DeFi. Early community testing showed over 80% of new users could explain the product after a single session. A rare outcome for a 0→1 financial tool.

Then came real-world moments that proved the design’s value:

When Cetus Protocol was exploited for $250M, 80% of assets were recovered in just 17 days. It was a payday for claim buyers using Incentive’s infra.

Dexodus Finance saw a recovery rate of 90%, creating new yield opportunities for claim traders on our platform.

After SwissBorg’s $41M SOL Earn exploit, users were able to trade their locked claims instantly using Incentive.

Even during the Nemo Protocol exploit on Sui, users could list their claims on Incentive the same day, turning panic into participation.

Those cases made one truth visible: when the UX is clear, people act fast, and in DeFi, speed defines survival

Challenge

There were no existing models for this product. Designing it meant inventing interaction patterns, vocabulary and user education all at once. I kept referring back to lessons from early fintech design teams like Stripe and Coinbase. They focused on removing friction and communicating calm, even when the subject was complex.

For Incentive, the hardest part was not the interface but the language. The product deals with loss and risk, two emotionally heavy states. We had to explain what a collateralized claim was, while keeping the tone steady and human. I wrote microcopy that sounded like a guide, not a contract.

Learnings

This project taught me how to design when trust is at its lowest. I learned how to turn highly technical systems into experiences that feel human and believable. I learned to use language as a design tool, to make uncertainty feel navigable instead of frightening.

Most importantly, Incentive showed me that clarity is not decoration in DeFi. It is infrastructure.

Happy testimonials

“I thought DeFi insurance was a myth. Incentive made it make sense.”

— Early testnet user

Miyo Danzel 2025